The economy of Bangladesh is currently going through major challenges with steps being taken

to address its many formidable challenges. In this context there are renewed interest on the

present state of the country's banking and financial institutions.

As has been in the past, present edition of the Banking Almanac has also been carefully

compiled with well researched and meticulously collected primary and secondary data and

information on the banking and financial institutions of Bangladesh. The resources presented in

the Almanac shed ample light on the organisational structure, geographical and locational

distributions of services of these institutions, their capital bases, services provided and myriad

other operational details.

All users of the Almanac will hopefully find it useful for their specific purposes and they will

have a unique readily available source of all important information in it, in one compendium

edition, shedding light on the state of our banks and financial institutions and their operations.

The state of the banks and financial institutions in Bangladesh are always at the centre of great

interest as in a major way, along with other relevant indicators, mirrors the condition of the

economy of Bangladesh. Well functioning banking and financial institutions are critical to ensure

the health of the real economy of Bangladesh, growth in it, the external and trade related

transactions of the country and the success of efforts to implement effective and purposive use of

these institutions to achieve national economic objectives.

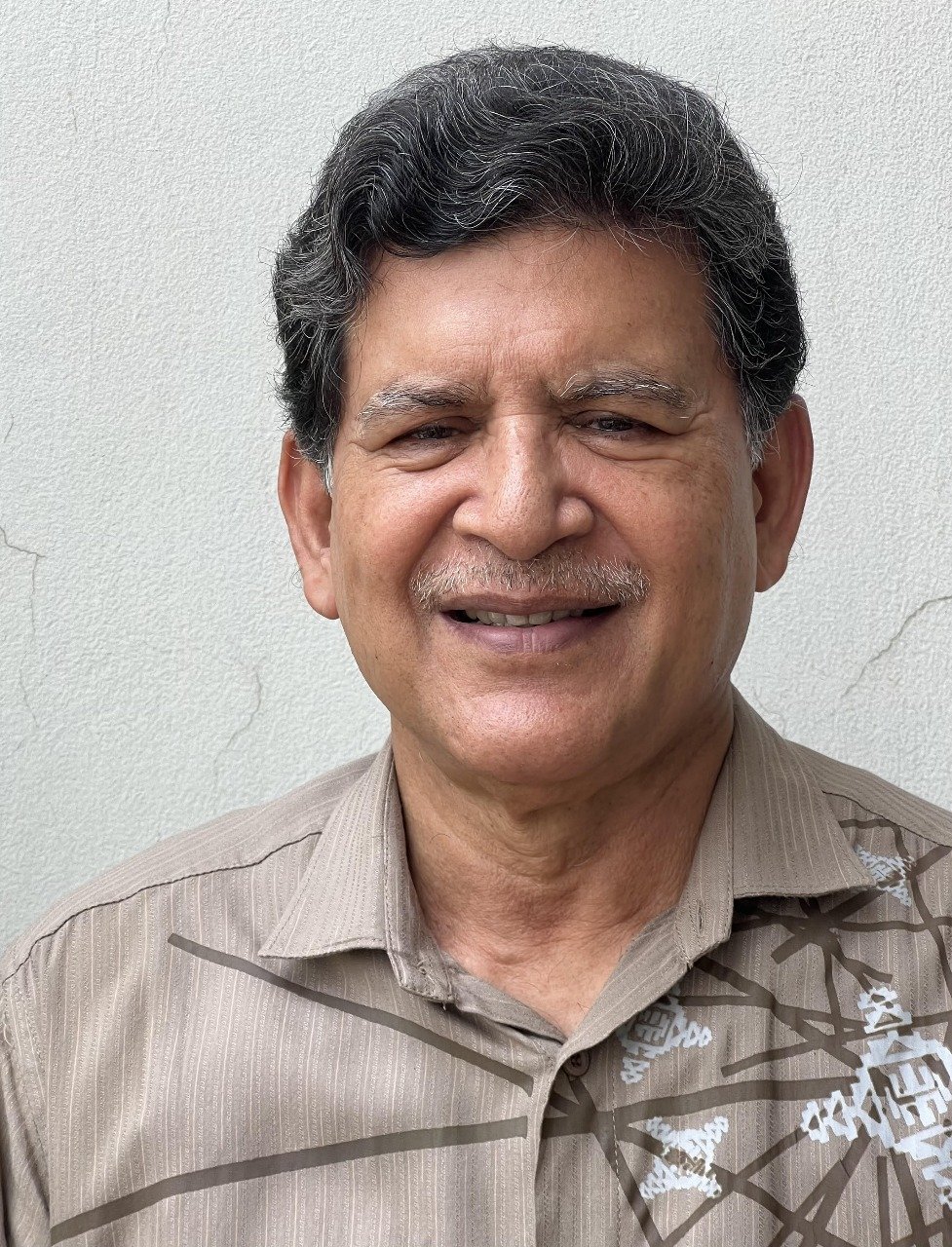

Adviser

Ministry of Finance

Government of the People’s Republic of Bangladesh

Dr. Salehuddin Ahmed

Adviser

Ministry of Finance

Government of the People’s Republic of Bangladesh

The current Interim Government has started work in all earnest for forward looking comprehensive democratic constitutional reforms, strengthening of the judiciary of Bangladesh, improving the country’s law and order situation, making civil administration of Bangladesh effective and people oriented while at the same time, among many other initiatives, bringing in much needed developments in the country’s education and health system. Restoring the health of the economy of Bangladesh-especially containing inflation, accelerating growth in the real economy and addressing the challenges being faced by the balance of payment of Bangladesh are also receiving priority attention of the Interim Government. The challenges in all these areas are most formidable. But our government is committed to address them seriously which are also the expectations of the people of Bangladesh. We are having a serious look at how our banking and monetary sector should be reformed to serve our priority economic objectives. Read More

Acting Chairman

Board of Editors

Banking Almanac

Dr. Hossain Zillur Rahman

Acting Chairman

Board of Editors

Banking Almanac

The popular uprising ignited by student protests of July-August 2024 has brought about a seismic change in the political landscape in Bangladesh whose ramifications are reverberating most loudly in the banking sector. The preceding year of 2023 when the distress in the banking sector stemming from a virtual collapse of governance standards was becoming acutely apparent can now rightfully be examined in-depth for corrective measures aimed at restoring the health of the banking sector as a vital prop for a thriving economy. The Interim Government, which has been in place since August 2024 has begun the process of addressing the weaknesses and fragility of the banking sector through bold and specific steps. It is matter of great pride that the Founder-Chairman of Banking Almanac Dr. Salehuddin Ahmed has been appointed to the cabinet position of Finance Advisor and tasked with leading the process of banking and economic recovery. Read More

Governor

Bangladesh Bank

Dr. Ahsan H. Mansur

Governor

Bangladesh Bank

It is my great pleasure to learn that the sixth and the latest edition of the Banking Almanac (Banks and Financial institutions in Bangladesh) will be shortly made available in the public domain following the long tradition of regularly bringing out of such Almanac. Bangladesh Bank has a deep commitment to encourage and support initiatives to ensure transparency and ready availability of data and information on the monetary and financial sector of Bangladesh. Such initiatives facilitate informed decision making, rule-based operation of our banks and financial institutions under careful much needed national oversight and well researched broader assessment of the state of our economy. The regular bringing out Banking Almanac, supplementing Bangladesh Bank’s own information compilation and dissemination, serves this laudable objective. I am indeed pleased to know that support and financial assistance from Bangladesh Bank have also contributed significantly to the work on the sixth edition of the Banking Almanac. Read More

Deputy Governor

Bangladesh Bank

Ms. Nurun Nahar

Deputy Governor

Bangladesh Bank

The financial sector of Bangladesh has evolved remarkably since the nation’s independence in 1971. From a primarily agrarian economy, we have transitioned to a diversified economy where the industrial and service sectors now play an equally significant role alongside agriculture. With this transformation, banks and finance companies have emerged as a cornerstone of our economic growth, driving savings, investments, trade, and commerce. Their contribution to ensuring financial stability, promoting financial inclusion, and supporting Sustainable Development Goals (SDGs) is indeed commendable. Amid a plethora of global challenges such as the aftermath of the COVID-19 pandemic, disruptions in global supply chains, inflationary pressures, climate change, and geopolitical tensions, Bangladesh Bank, as the Central of Bank of Bangladesh, has demonstrated unwavering commitment to safeguarding the stability of the financial sector, implementing measures to mitigate risks, fostering resilience, and supporting economic recovery. Read More

Chairman

Bangladesh Association of Banks (BAB)

.jpg)

Mr. Abdul Hai Sarker

Chairman

Bangladesh Association of Banks (BAB)

Chairman, Dhaka Bank PLC

I am delighted to know that the 6th Edition of “Banking Almanac: Banks and Financial Institutions of Bangladesh” has recently been published by the Educational National Weekly ‘Shikshabichitra’ with the assistance of Bangladesh Bank. Banks and Financial Institutions are the Corner Stones of National Economy and play a very significant and crucial role in the growth, development and employment generation in various sectors of the economy. ‘Banking Almanac’ has made an effort to publish latest information and data of Banks and Financial Institutions of the country. I would like to thank the Project Director, Banking Almanac for taking the arduous responsibility of collecting and accumulating latest information and data of country’s Banks and Financial Institutions. I think this initiative will also be an invaluable resource for the Bankers, Investors, Researchers, Teachers, Students and any one related with the Financial Sector.

Finally, I would like extend my sincere appreciation to the Board of Editors and Publishers of the ‘Banking Almanac’ for their dedication to the initiative. Read More

Chairman

Association of Bankers

Bangladesh Limited (ABB)

Mr. Selim R.F Hossain

Chairman

Association of Bankers Bangladesh Limited (ABB)

On behalf of the Association of Bankers Bangladesh Limited (ABB), I am delighted to convey our warmest greetings to all the readers of the Banking Almanac: Banks and Financial Institutions of Bangladesh, 6th Edition and our congratulations to the editor and publisher for their commendable effort in bringing out such an important publication.

This publication remains an invaluable resource, offering comprehensive insights and analysis into the evolving landscape of our banks and financial institutions. Such access to information to the general public ensures transparency, good governance, and accountability for banks and financial institutions operating in Bangladesh. Its significance extends to various stakeholders, including policymakers, industry experts, and the general public.

We appreciate the wholehearted dedication and meticulous efforts of the Editorial Board in curating this publication and also acknowledge the support of the Bangladesh Bank, for their proactive role in patronizing this publication. Their guidance and collaboration have been instrumental in ensuring the continued success of the Banking Almanac.

We look forward to continuing our journey together to shape a robust and resilient financial sector for Bangladesh.

Read More

Chairman

Bangladesh Leasing and Finance Companies Association (BLFCA)

Mr. Md. Golam Sarwar Bhuiyan

Chairman

Bangladesh Leasing and Finance Companies Association (BLFCA)

Managing Director, IIDFC PLC

It is my privilege to extend warm greetings to the resilient Banking and Financial Institutions community of our country. Bangladesh achieved a strong rebound from the COVID-19 pandemic, though this post-pandemic recovery faced significant challenges in FY23, marked by rising inflation, financial sector vulnerabilities, external pressures, currency devaluation, and global economic uncertainties. Yet, the country has demonstrated notable resilience, with GDP growth anticipated between 5.4% and 6.5% in 2024. Our manufacturing and service sectors, with essential support from the banking and financial institutions, continue to uphold this resilience.

Today, I am delighted to celebrate the launch of the Banking Almanac: Banks and Financial Institutions of Bangladesh, a testament to our community’s enduring strength and contributions. From its modest beginnings in a fragile economy, Bangladesh’s financial sector has brought stability and steady progress, even amid numerous crises over the past half century of its independence.

Read More

Abdar Rahman

Project Director, Banking Almanac

Abdar Rahman

Project Director, Banking Almanac

The publication of the 6th edition of the Banking Almanac marks another significant milestone in our journey to document and analyze Bangladesh's financial landscape. This publication stands as an indispensable resource for policymakers, researchers, academics, and professionals, providing a comprehensive and reliable database of the banking and non-bank financial institutions. It's more than just a book; it’s a detailed chronicle of the sector's growth, challenges, and evolution. Banking Almanac is a research and publication initiative of ShikkhaBichitra, which has been published since 2016 with the support of Bangladesh Bank.

The Banking Almanac has consistently aimed to bridge the information gap, offering a unique blend of data-driven insights and analytical perspectives that are crucial for informed decision-making. The 6th edition, with its focus on the years 2022 and 2023, meticulously compiles updated information and statistics, ensuring its relevance and utility.

Banking Almanac has been published under the guidance of eminent economists, researchers and banking professionals. Dr. Salehuddin Ahmed, Honorable Finance Adviser to the Government of Bangladesh is the Founder Chairman of Editorial Board and Dr. Hossain Zillur Rahman, former adviser to the Caretaker Government of Bangladesh is the Acting Chairman of the Editorial Board. We want to express our deepest gratitude to the esteemed members of our Editorial Board. Their rigorous review process and intellectual contributions have ensured the quality and accuracy of every page.

We gratefully acknowledge the invaluable support and cooperation of Bangladesh Bank, without which the journey of the Banking Almanac would not have been possible.

We want to express our thanks to the Executive Editors, research associates and the entire publication team. The success of the Banking Almanac’s incredible journey is a testament to their invaluable hard work and cooperation

We also extend our heartfelt thanks to all the financial and other collaborators whose generous support has been crucial in bringing this project to fruition. Their belief in the importance of this work has been a driving force.

As we look ahead, we are committed to continuing this vital work, exploring new avenues to enhance the accessibility and depth of our research. The Banking Almanac will remain a steadfast companion to all who seek to understand and contribute to the future of Bangladesh's financial industry.

Banking Almanac: 2023 (Sixth Editon)--- A research project of the ShikkhaBichitra. The project is being supported by Bangladesh Bank & other Banks and Financial Institutions, published by Abdar Rahman, Editor: The Weekly ShikkhaBichitra, Project Director : Banking Almanac, House Number 196/3, Shantibag (2nd Floor), Dhaka-1217, Cell: 01715-839515, E-mail: ardssb@gmail.com, bankingalmanac@gmail.com website: www.bankingalmanac.com. Published in December 2024. Total pages 604, ISBN: 978-984-36-0736-2. Price: BDT 1250.00, USD: 100